Below are some means that you can stop requiring SR22 insurance policy. Don't drink and also drive. This might feel like an easy as well as very easy principle, however countless individuals still do it every year. Simply one drink might put you over the lawful limitation. Discover what your alcohol limit is according to your weight as well as make sure you remain under.

If you have currently had a DUI or DWI, make sure you discover accountable ways to have fun when driving that DO NOT include alcohol. Do not drive without insurance coverage. This is not only high-risk for you however, for other drivers when traveling. Pay your tickets as well as penalties to ensure that your vehicle drivers permit is not revoked.

You may even have to go to website traffic institution. This is constantly a much better option than having your vehicle drivers license eliminated. Prevent negligent driving. This could suggest auto racing, driving unlawfully, roadway craze and a wide variety of other points. insurance. You need to obey website traffic legislations and also try to drive as securely as possible.

Always have you proof of insurance as well as vehicle registration offered. It is prohibited to not have evidence of insurance policy while driving. Here are the states that do not need SR22: Also if these states do not require this declaring, you have to keep SR22 insurance coverage if you are relocating to a state that requires it - deductibles.

The Definitive Guide to Sr-22 Car Insurance In Texas - Quotewizard

When you make the right selections, data for SR22 and also maintain an excellent driving document, you will as soon as again obtain your life back on track. The fee for this filing is typically under $50.

You will certainly need this insurance policy for 3 years. Despite the fact that this may cost you more, in the long run, you will certainly be pleased to understand that your SR22 insurance can be gone down as well as you can advance as a regular driver. A DUI however does take up to 10 years to leave your record (insurance).

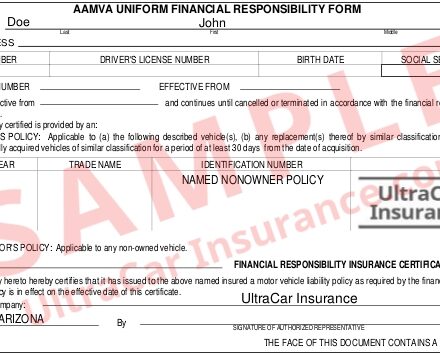

What is Non-Owner SR-22 Insurance Coverage as well as Why Would Certainly I Need It? Non-Owners SR-22 insurance coverage is essentially insurance policy for your vehicle driver's license and also enables you to obtain your certificate renewed by the State. If you've just recently been drawn over by the authorities as well as after that recognized that the vehicle you're driving did not have insurance, the officer will probably have actually issued you a ticket for driving without insurance. insure.

What Do Non-Owner SR-22 Plans Cover? The Non-Owners SR-22 plan will certainly cover you from being released a ticket for driving without insurance in case you enter into the same scenario as prior to: driving somebody else's uninsured automobile. Need to you be in a crash, this insurance policy will certainly not cover the insurance claim, but it will certainly act rather as insurance policy for your permit so it is not withdrawed (motor vehicle safety).

The Main Principles Of Cheap Sr-22 Insurance - Youtube

You'll have the ability to obtain a quote online and also acquire the policy for your instant proof-of-insurance within mins. To make an application for a quote, merely click the "Get a Quote" button at the top of the web page (or click below) as well as enter your zip code. As soon as you've submitted the type, complete the required info page and also be sure to choose the 'I do not have a vehicle' choice when triggered.

Understood as monetary responsibility insurance policy, this certification proves to the DMV as well as courts that you have the financial capability to pay the losses that one more individual suffers if you create a crash. If you're asking yourself just how much an SR-22 insurance prices, you can obtain SR-22 insurance quotes from us.

It might be called for if you have actually been discovered guilty of a DUI or DWI, triggering a substantial accident, or driving without insurance coverage (vehicle insurance). What Is the Price of SR-22 Insurance? You'll pay a minimal charge to your insurance provider for this certification. It might be more pricey to get liability insurance if you have an SR-22 demand.

What Are the Filing Requirements in Illinois? SR-22 documentation is provided straight from the insurance provider to the Department of Electric Motor Automobiles. It must be preserved for three years. If it is terminated or ends, the insurer needs to send out a letter to the Security and also Economic Responsibility Department to report it.

Insurance Coverage Navy Names The Most Inexpensive Used ... for Beginners

department of motor vehicles liability insurance sr22 insure sr22 coverage

department of motor vehicles liability insurance sr22 insure sr22 coverage

When Do You Need an SR-22? The DMV will mention when an SR-22 is a requirement. This might happen after: You are guilty of driving intoxicated (DUI or DWI) convictions. Your vehicle driver's certificate has been put on hold or withdrawed in the last couple of years. You are found to be driving with run out certificate plates.

Oxford Automobile Insurance policy also allows you pay online, for your convenience. Get in touch with our insurance coverage representative to have any of your questions responded to about SR-22 coverage.

car insurance insurance group insurance dui sr22 coverage

car insurance insurance group insurance dui sr22 coverage

The gives $25,000 physical injury for any kind of 1 person injured/ $50,000 bodily injury per accident when 2 or more people are injured, and $25,000 in residential property damage liability coverage in case you are at mistake in an accident. It covers you as a motorist - department of motor vehicles. An does not cover the cars and truck you are driving or the cars and truck you have.

SR22 insurance coverage is something of a misnomer. The phrase "SR22 insurance policy" is really a term used to explain a proof of coverage need that uses to some motorists. In lots of states, particular risky drivers may be required to get an SR22 certificate of insurance. This certification shows that the person has the necessary automobile insurance coverage and also is meeting the state's economic as well as liability duty demands.

Next Insurance: Small Business Insurance Quotes Can Be Fun For Anyone

It's a certification that confirms you have vehicle insurance. You might likewise hear it called an SR22 bond or a certificate of monetary responsibility. Whatever you call it, it's something that lots of motorists need. If you have actually been told you need SR22 insurance coverage, you've concerned the best area. We can help you get the insurance coverage you require.

You need SR22 insurance coverage if your state's DMV informs you that you need SR22 insurance coverage. SR22 insurance isn't a need that vehicle insurer trouble chauffeurs. It's a lawful demand that mentions need of some chauffeurs. In basic, specific chauffeurs who are thought about "high threat" might be required to get SR22 insurance policy.

SR22 insurance policy is an extremely typical need, and we can assist you obtain it. SR22 insurance coverage will certainly offer evidence that you have actually purchased the minimum responsibility coverage needed in your state.

In enhancement to liability coverage, the state might require vehicle drivers to buy extra types of protection, consisting of injury protection (PIP) and uninsured motorist coverage. Other kinds of coverage, consisting of crash as well as detailed insurance coverage, will certainly also be available however will typically not be needed by law. If you transfer to one more state with reduced insurance demands, or without SR22 demands, you may still need to meet the SR22 insurance demands of the state that issued the SR22 requirements.

The Greatest Guide To Cheap Sr22 Insurance! Only $7/month, Free Quote Here!

driver's license insure insure insurance division of motor vehicles

driver's license insure insure insurance division of motor vehicles

You won't need SR22 insurance policy permanently. In several states, motorists that need SR22 insurance are required to carry it for three years.

If your state considers you to be a high-risk vehicle driver, you may be needed to lug SR22 insurance policy to have your certificate reinstated. This is real whether you possess a vehicle. SR22 insurance verifies that you have the liability insurance policy needed to spend for any type of injuries or property damage that you might cause.

If you do not have an automobile as well as you need SR22 insurance coverage, you will certainly require to obtain non-owner SR22 insurance coverage. In some circumstances, you might be needed to purchase SR22 insurance policy also though you don't own an automobile.

This paper will certainly prove that he has the insurance coverage he requires when he is driving any type of automobile. Although it may appear a little weird at first, the requirement does make feeling. SR22 insurance coverage is expected to show that you are monetarily in charge of any collision that you might trigger despite whose auto you're driving (sr22 coverage).

The Facts About Crude Falls; Indian Refiners To Cut Saudi Oil, Russian Exit To Cost ... Revealed

In some states, you may be required to get FR44 insurance policy rather of SR22 insurance policy. FR44 insurance coverage is similar to SR22 insurance.

The trouble is that you will likely pay greater premiums compared to vehicle drivers who do not need SR22 insurance policy. This is because you are considered a high-risk vehicle driver. Furthermore, the very same elements that resulted in your having to obtain SR22 insurance policy to begin with like getting a DUI or driving without insurance will additionally impact your auto insurance coverage costs - car insurance.

Non Proprietor Policy - Non-owner insurance provides secondary liability insurance coverage. A non owner vehicle insurance coverage policy is suitable for people that don't possess a car, but periodically obtain a good friend's or neighbor's automobile.

Every situation calling for an SR22 is distinct so, consult the state to confirm your specific SR22 requirements. Please keep in mind to maintain the SR22 for the defined amount of time without any lapses or cancellations. If the policy terminates for any kind of factor, the insurance policy provider is legitimately obliged to alert the state, this is called an SR26 (underinsured).

The Best Strategy To Use For How To Find High Risk Connecticut Car Insurance Rates For ...

SR22 for Several Violations If you have several DUI sentences for driving infractions, we can still supply car insurance policy that pleases SR22 needs. We have years of experience finding the most budget friendly SR22 car insurance coverage for risky vehicle drivers of all kinds. What Is SR22 Car Article source Insurance Coverage?, your automobile insurer have to submit an SR22 certificate with the DMV.

Maine, New Hampshire, Ohio, Wisconsin, and also Idaho are the cheapest states for cars and truck insurance coverage. Read this short article to comprehend why.

Having to submit an SR-22 is no person's idea of enjoyable. You'll pay greater auto insurance premiums than a driver with a clean record as well as you'll be restricted in your selection of insurance firms. Going shopping around for the most affordable prices can aid. Here's what you require to understand. See what you can minimize cars and truck insurance coverage, Easily compare tailored rates to see just how much switching automobile insurance policy might save you.

You could be needed to have an SR-22 if: You have actually been convicted of DUI, Drunk driving or one more significant relocating offense. You've created a mishap while driving without insurance.

The smart Trick of New Hampshire Sr-22 Insurance For 2022 That Nobody is Discussing

For sure convictions in Florida as well as Virginia, you may be bought to submit a comparable type called an FR-44. This calls for a greater level of liability coverage than the state's minimum. Not all states need an SR-22 or FR-44. If you need one, you'll discover out from your state division of automobile or web traffic court - credit score.

When you're alerted you require an SR-22, start by contacting your automobile insurer. Some insurance firms don't supply this solution, so you might need to buy a firm that does. If you don't currently have vehicle insurance coverage, you'll most likely require to purchase a policy so as to get your driving opportunities brought back.

Non Proprietor Policy - Non-owner insurance policy gives additional obligation protection. A non proprietor vehicle insurance plan is excellent for individuals that do not possess a lorry, but occasionally obtain a buddy's or neighbor's auto. An SR22 can be affixed to a non-owner auto policy and is regularly the cheapest. Learn more regarding non-owner insurance below.

Every scenario needing an SR22 is unique so, get in touch with the state to verify your particular SR22 requirements. Please keep in mind to preserve the SR22 for the defined quantity of time without any kind of gaps or terminations - deductibles. If the policy terminates for any factor, the insurance carrier is legitimately bound to inform the state, this is called an SR26.

The Buzz on Ruger M77 Compact. Features An Engraved Ruger Logo And ...

SR22 for Numerous Offenses If you have multiple DUI convictions for driving infractions, we can still supply vehicle insurance policy that pleases SR22 needs. We have years of experience finding one of the most affordable SR22 automobile insurance policy for high-risk drivers of all kinds. What Is SR22 Cars And Truck Insurance Coverage?, your automobile insurer have to submit an SR22 certificate with the DMV.

Maine, New Hampshire, Ohio, Wisconsin, as well as Idaho are the cheapest states for cars and truck insurance coverage. Review this article to understand why. motor vehicle safety.

You'll pay greater automobile insurance costs than a vehicle driver with a tidy record and you'll be restricted in your selection of insurance firms. See what you can conserve on auto insurance, Conveniently compare individualized rates to see just how much switching vehicle insurance policy could conserve you.

You could be required to have an SR-22 if: You've been convicted of DUI, drunk driving or another severe relocating offense. You have actually created an accident while driving without insurance. You have actually gotten a lot of website traffic tickets in a short time, such as 3 or even more speeding tickets within six months. You really did not pay court-ordered child support.

The Of Cheap Sr-22 - Bankrate

For specific convictions in Florida as well as Virginia, you might be purchased to file a comparable type called an FR-44 - vehicle insurance. This requires a greater degree of responsibility coverage than the state's minimum. Not all states call for an SR-22 or FR-44. If you require one, you'll discover from your state division of automobile or web traffic court.

insure insurance companies deductibles coverage division of motor vehicles

insure insurance companies deductibles coverage division of motor vehicles

When you're informed you need an SR-22, start by contacting your automobile insurance provider. Some insurance providers don't offer this solution, so you may need to buy a firm that does. If you do not already have vehicle insurance policy, you'll probably require to buy a policy so as to get your driving advantages brought back.