For context, the minimum liability protection for a typical vehicle driver is just $10,000 for bodily injury or fatality of someone. 7 Where to get an SR-22 If you think you need an SR-22, talk to an insurance policy representative. They'll have the ability to assist you through the entire SR-22 filing process and make certain you're meeting your state's insurance guidelines.

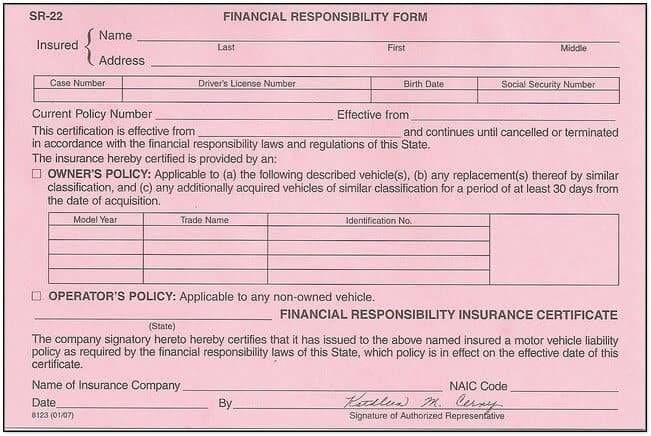

What is a Financial Responsibility Insurance Policy Certification (SR-22) A Financial Duty Insurance Certification (SR-22) is called for by the Texas Transport Code Phase 601 to confirm that you are preserving automobile responsibility insurance coverage. A SR-22 can be released by the majority of insurance suppliers and also accredits that you have the minimum liability insurance policy as required by regulation. insurance group.

Minimum Responsibility Amounts The minimum liability insurance coverage amounts needed by law are: $30,000 for bodily injury to or fatality of someone in one collision, $60,000 for physical injury to or death of 2 or more individuals in one crash, and $25,000 for damage to or devastation of building of others in one crash - vehicle insurance.

Chauffeur License Reinstatement Requirements To renew your driver license you have to: Send a valid SR-22 to the Department, as well as Pay the needed $100 Reinstatement charge before the renewal or issuance of your driver permit, in addition to paying any type of other outstanding charges owed. * If you are convicted of a second or succeeding violation for No Motor Lorry Responsibility Insurance coverage yet had insurance coverage on the automobile at the time of the violation, you may send your proof of insurance policy as well as the SR-22 need will be waived.

Vehicle Driver Eligibility Standing To examine the standing of your driver certificate or to figure out if you are qualified for reinstatement, check out the License Eligibility web page (credit score). This page will certainly give you with details on what you will certainly need to reinstate your vehicle driver certificate or driving advantage, including any costs you might owe.

For additional information on SR-22 (Proof of Financial Obligation), please see the Frequently Asked Inquiries web page or download the Driver Certificate Enforcement Actions graph for a complete checklist of driver permit suspensions as well as abrogations. sr22 insurance.

What Does Insurance - Nevada Department Of Motor Vehicles Mean?

Exactly How Does SR-22 Coverage Job? An SR-22 (monetary duty) is likewise recognized as SR-22 insurance coverage or Certification of Financial Responsibility (CFR) - deductibles. The SR-22 plan was produced to make it difficult for risky vehicle drivers to run a vehicle without insurance policy. The Department of Motor Automobiles (DMV) utilizes the SR-22 insurance coverage certificate in Texas and also Nevada to validate that a high-risk vehicle driver has the state-required insurance.

That is Required to Carry SR-22 Insurance? Put simply, motorists that have been founded guilty of severe electric motor vehicle-related offenses, consisting of driving without insurance, are required to bring the Texas and also Nevada SR-22 insurance policy certificate. The DMV notifies the individual that she or he has actually been marked a risky motorist based on the SR-22 need.

You might need to have an SR-22 on file for one to 5 years, depending on the state. What Is SR-22 'Insurance'?

Who Requirements an SR-22 Certificate? The guidelines for when an SR-22 is needed differ by state, and not all states require chauffeurs to have one. In Texas, as an example, chauffeurs are required to submit an SR-22 with the state department of insurance coverage if their permit was suspended due to an automobile crash, they have actually received a 2nd or subsequent sentence for not having responsibility insurance, or a civil judgment has been filed against them.

Once again, not everybody needs an SR-22. However usually, you may be called for to have one if you: Are caught driving without a license or insurance coverage, Have a driving intoxicated (DUI) or driving while intoxicated (DWI) sentence, Have a license suspended because of excessive crashes or moving offenses, Owe superior court-ordered kid support payments, Incur multiple repeat driving offenses quickly framework, Are requesting a challenge or probationary driving license Remember that you may be required to have an SR-22 on documents in the state you're certified in also if you live and drive in another state. sr-22 insurance.

Important If you allow your SR-22 certification to gap, your vehicle driver's license can be put on hold. Some states require insurance business to alert them when an SR-22 lapses or is canceled.

The Main Principles Of Secrets Of Sr-22 Insurance From A San Diego Dui Attorney

Or you might require to keep it for up to five years. Washington state divides the distinction as well as sets its need at 3 years - dui. If you require an SR-22, it is necessary to understand when the clock starts ticking. The window of time you're required to have the certificate may begin on the day your license was originally suspended.

If you're acquiring a new cars and truck insurance coverage, you may have the ability to conserve cash by looking around - insurance coverage. Inform the insurance firm upfront that you need an SR-22, just to make sure the company offers them. As soon as you have an SR-22 certification, the insurer will submit it with the state on your part.

Secret things to learn about SR-22 insurance prior to buying. insure., Car Insurance coverage Writer, Feb 18, 2022.

SR-22 insurance coverage in Texas, An SR-22 basically informs the DMV, or the State of Texas, that the insurer who provided the form licenses that you contend least the minimum amount of cars and truck insurance coverage called for, and also that you're monetarily prepared in case of a crash or claim. It can be simple to confuse an SR-22 with cars and truck insurance coverage - ignition interlock.

Actually, one factor drivers require an SR-22 is if they were captured driving without insurance policy. Other insurance types needed in Texas, Drivers in Texas must also know there are 2 different sorts of SR-22 forms which may be needed. Both are Proof of Financial Responsibility types, but the conditions will inevitably establish which specific one satisfies is needed. sr22 insurance.

Insurance coverage companies will certainly check your driving record prior to they release you a vehicle insurance policy. Speeding tickets, web traffic violations as well as crashes will suggest your cars and truck insurance policy will be much more pricey than someone with a clean history.

The Best Strategy To Use For Sr22 Insurance Faqs

Along with the expense of the SR-22 insurance protection, as well as a probable insurance policy price boost, you'll also likely need to pay a $100 certificate reinstatement charge to the Texas Department of Public Safety. When you purchase an SR-22, you need to remain on top of your auto insurance repayments for the following 2 years.

Non-owner SR-22 insurance coverage for Texas vehicle drivers, If you 'd like to restore your motorist's license yet you do not have an auto to insure to also obtain an SR-22, there is a workaround. The plan will insure you, regardless of what automobile you drive.

If you already have an active insurance coverage that satisfies state minimum needs, you might even be able to get an SR-22 from a different insurance firm. If not, you'll need to acquire vehicle insurance policy prior to the SR-22 can be released. SR-22 insurance does not exist, rather you need to have the SR-22 Texas kind released on your behalf as proof of an existing policy - ignition interlock.

Which states need SR-22s? Each state has its very own SR-22 coverage requirements for motorists, and all are subject to transform. Get in touch with your insurance carrier to discover your state's existing demands as well as make certain you have adequate coverage. The length of time do you require an SR-22? A lot of states require drivers to have an SR-22to prove they have insurancefor regarding three years.

Many people may not recognize much about SR22 insurance. SR22 is a record produced by an insurance coverage company and filed with DMV verifying that a driver has sufficient automobile responsibility insurance policy.

Drivers that have actually had their licenses put on hold or revoked due to cars and truck mishaps, speeding, or driving while intoxicated are normally the ones required to comply (no-fault insurance). The insurance company will certainly also keep the state upgraded on your car insurance coverage renewals as well as cancellations. The state typically demands this filing for a couple of years to ensure you are keeping your insurance in great standing regularly.

Getting My Sr22 Insurance Faqs To Work

However, one of the most constant reasons are: If you have been caught driving without a valid insurance policy If you are caught driving intoxicated or while intoxicated If you are caught driving without a license or with an expired one If you have way too many tickets in the short time framework If you like on-line acquisitions, you can get your insurance coverage through the Internet, or you can call an insurer and satisfy with the representative.

That might be challenging because fees differ from state to state. On the other hand, if you directly contact your representative, you will promptly discover how much cash you need to get ready for fees. Not every insurer supplies SR22 insurance coverage. This can be due to the reality that motorists subject to the classification are likewise thought about high-risk vehicle drivers.

An SR22 is there to cover home damage and also any type of obligation developing from an accident in which the covered driver is entailed. It is taken into consideration a "monetary duty" insurance policy due to the fact that it covers the motorist's responsibility to others who may be entailed in an accident (coverage). It will not, in all situations, cover the repair work or substitute value of the owner's automobile or that of the various other vehicle entailed in the crash.

If you are looking for the finest rates for SR22 insurance in California, call our experts at Breathe freely Insurance coverage today (vehicle insurance).

Get in touch with your insurance coverage company to find out your state's present requirements and also make certain you have adequate protection. Exactly how long do you require an SR-22? Many states need motorists to have an SR-22to prove they have insurancefor regarding three years.

Several people may not recognize much concerning SR22 insurance. Perhaps you recognize an individual that required it at one factor in their lives. Or, maybe you are that person? We are mosting likely to try to clean up a couple of concerns regarding this problem. SR22 is a paper generated by an insurance business and also submitted with DMV validating that a driver has appropriate car liability insurance.

Not known Details About Missouri Sr-22 Insurance Questions

Chauffeurs that have actually had their licenses suspended or withdrawed because of auto accidents, speeding, or driving while intoxicated are typically the ones needed to abide. sr22 coverage. The insurance provider will likewise keep the state upgraded on your car insurance coverage renewals and also cancellations. The state usually demands this declare a few years to see to it you are keeping your insurance coverage in good standing constantly.

Nevertheless, the most frequent reasons are: If you have actually been caught driving without a valid insurance policy If you are captured driving intoxicated or while intoxicated If you are captured driving without a license or with an ended one If you have a lot of tickets in the brief time frame If you prefer online purchases, you can obtain your insurance coverage using the Net, or you can call an insurance coverage business and also consult with the representative.

That might be challenging since fees vary from state to state. On the various other hand, if you straight call your representative, you will instantly learn just how much cash you need to get ready for charges. Not every insurer uses SR22 insurance coverage. This can be because of the truth that vehicle drivers subject to the category are also taken into consideration risky motorists.

An SR22 is there to cover residential property damages and also any kind of liability developing from a crash in which the covered vehicle driver is entailed. It is taken into consideration a "economic responsibility" insurance policy since it covers the motorist's obligation to others that might be involved in a crash (deductibles). It will not, in all situations, cover the fixing or substitute worth of the owner's auto or that of the other car included in the mishap.

If you are looking for the most effective rates for SR22 insurance in The golden state, call our specialists at Breathe freely Insurance policy today.